Startup founders are no stranger to pitch decks. In fact, one could argue that pitch decks are crucial for startups to find their footing. And by footing, what we actually mean is funding. No matter which way you spin it, a new company needs money to get their idea off the ground.

There are no two businesses that are the same. Each company is unique in their own business plan, goals, and growth trajectory. And that’s why funding isn’t one-size-fits-all. What one company needs might not even scratch the surface for another. To accommodate startups at every level there are various stages of funding from pre-seed to Series D. Each series is significant to the size, maturity, and needs of the company.

While the series are different in their own right, it can be confusing for founders and CEOs trying to make a distinction when crafting their pitch. In this blog we’re pitting Series A and Series B against each other, comparing the two, and explaining how your pitch deck will vary depending on which stage you’re at in the funding process.

Series A vs. Series B

What are the key differences between the Series A and Series B funding stages?

To put it simply, Series A and Series B are two different points in a business’s growth journey— each representing a specific stage in the development of a new company.

Series A usually comes after the initial seed round of funding, and is designed for startups that have already proven their concept, have a functioning product or service, and are looking to scale their operations. At this point in the business startups often have some initial customer traction but may not be profitable yet, and need the extra financial boost to support the team’s efforts to scale. Startups at this phase will often attract venture capital firms and investors who specialize in early-stage investments.

After Series A comes Series B. A Series B round is for startups that have demonstrated significant growth and are now looking to expand, requiring more employees and resources. Startups at this stage are usually more mature, meaning they have a strong customer base and are generating revenue to some extent. Series B funding is often used to fuel rapid growth and market expansion. Because startups have established themselves by this point, investors are looking for more substantial proof of success through reporting and meaningful data.

The difference between Series A and Series B when crafting a pitch deck

Now that we’ve defined both stages of funding, let’s apply that to your pitch deck. What do you need to include in a Series A pitch, and how does that differ from a Series B presentation?

What to include in a Series A pitch deck

The Series A pitch deck is typically used by startups in the early stages of growth to secure their first significant round of funding after seed funding. This pitch deck focuses on demonstrating market validation, traction, and potential for growth.

A Series A pitch deck should highlight the startup's product, market size, target audience, business model, competitive advantage, and initial customer acquisition strategies. Because early-stage startups may not have substantial revenue or profit to share quite yet, the deck can focus on financial projections, key performance indicators (KPIs), and details about how they plan to use the money raised to drive growth.

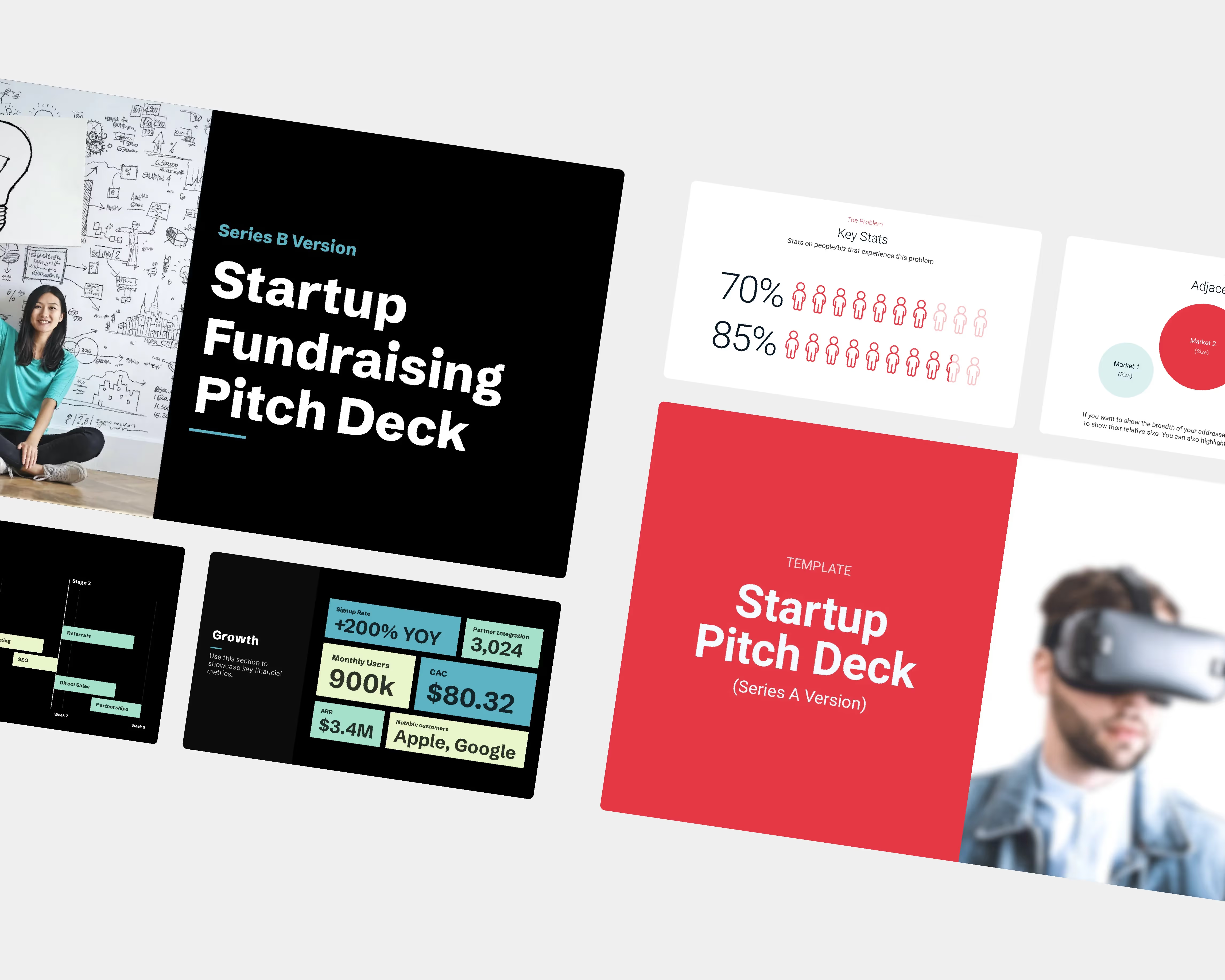

Your Series A presentation needs to be persuasive, concise, and professional. There’s a lot at stake for founders and investors alike, so having a carefully curated Series A pitch deck that clearly communicates the company’s goals can benefit both parties. If you don’t know where to start, let us help. Our pre-built, fully customizable Series A presentation template can help entrepreneurs get the funding they need.

What to include in a Series B pitch deck

Different from Series A, a Series B pitch deck is used when startups have matured and are seeking additional funding to accelerate growth and scale their operations. At this stage, startups are expected to demonstrate strong growth metrics, market traction, and revenue generation opportunities.

The pitch deck for Series B may emphasize the company's revenue projections, customer acquisition and retention strategies, expansion plans, team capabilities, and competitive landscape. The financial section of the pitch deck should provide a clear view of the startup's financial health, growth rates, burn rate, and opportunities for profitability. To drive the point home, it’s also important to include the projected return on investment for potential investors, so that they can make an informed decision in their best interest.

Because startups in Series B have more to prove, the pitch deck needs to be dialed in. Beautiful.ai’s Series B presentation template can give founders and executives the tools they need to stand out from the competition and wow investors— old and new. The customizable template has everything they need to stay organized in their pitch and raise the funds necessary to scale.